It would take only $5 worth of glue; yet nobody bothers fixing the obvious.

Ask Larry Kudlow, Ace Greenberg or Jimmy Cayne. Nobody does a thing about it.

Waist-high aluminum railings line our trading floor entry. One rectangular wooden cap at the end keeps falling out.

An exposed jagged edge tears into some of the most expensive clothing in America. I have yet another front row seat. It’s a riot.

Seasoned salesmen, naïve visitors or inattentive titans of industry destroy their custom suits from haberdashers like J. Press, Paul Stuart or Tripler. It never gets old.

The University Club guy holds court at volume 11 for everyone’s amusement, especially his own. High-grade bond salesman David Brown mocks frustrated aluminum railing victims to their faces, with neither shame nor malice.

“So sorry for your loss! There’s a fabulous tailor on 47th between Lex and 3rd. Please tell the owners that I sent you. They pay me a commission. This happens a lot. Welcome to Bear Stearns!”

Everyone laughs. Visitors too, sometimes. Everyone is getting used to the new digs.

After only a few months in the new offices, this place already looks like a war zone. The green-and-tan interior isn’t holding up so well. Ineffective plastic bumpers fail to protect the corridor wallpaper from the ravages of our mail room staff.

Huge metal carts are operated by young deaf women. Bear Stearns gets a tax break on loyal workers, who are less likely to share secrets between departments.

They routinely gossip about us in sign language. They know the names of everyone seated in these rows of trading desks and side executive offices. Support beams are covered in severed ties, cut off upon each new guy’s first trade. They find that funny.

Desktop fans at the old location blew second-hand cigar and cigarette smoke around for everyone to enjoy. No longer. New York City law recently outlawed smoking on trading floors. Nervous habits have now found some new outlets, like nicotine gum and Hacky Sack.

Wall Street is broken into three major participants: the sellside, the buyside and the wholesalers, called “street brokers.” Brokerage firms are considered the sellside. Money managers are the buyside. Wholesaler Cantor Fitzgerald is a broker’s broker.

Our 3rd floor Corporate Finance Department underwrites stock and bond deals for sales and trading personnel to sell to buyside customers. Desks like mine promote new issues to money managers and help them to find buyers, when they sell them.

Bear Stearns underwrites and trades “used” secondary market satellite and cell phone tower bonds. We also participate in the Nextwave bandwidth auctions.

New Bloomberg

The cell tower and satellite bond trader is a total hipster. He reads Interview Magazine, plays in a band and lives in the East Village. Hipster frequents The Acme Bar & Grill or Automatic Slim’s after hours.

He tosses a Hacky Sack from one hand to the other while staring at me on a slow day. Hipster announces for our entire junk bond desk entertainment, “Hey, listen up little fella. I spotted you south of 14th Street. And I gotta tell ya. I didn’t like it!”

The Village is Hipster’s exclusive territory. He wants me north of 72nd Street, where I supposedly belong. Maybe at Brother Jimmy’s BBQ or The Surf Club on 91st and York.

Hipster trades the bonds behind satellites, bandwidth and those new cell phone towers. Early 90’s bond investors front money for new technologies. They gamble by building the infrastructure, long before customers pay for cell phone service.

These risky companies delay interest payments until after they anticipate finally getting paid for their future services. They need to retain money in the meanwhile to erect towers or to launch satellites that generate cash flow, which repays their debt.

Calculating the yields on those bonds is a royal pain in the ass. We call them “step-up bonds,” because the coupon rate jumps from 0% to sometimes 14% after a few years.

Hipster just installed a tan boxy Bloomberg terminal. It requires an entirely new set of network wires and costs more than my salary. Bloomberg displays yields instantly.

The JOBS <Go> function is particularly helpful. I visit Bloomberg’s Park Avenue offices during lunch breaks to find another job without getting caught. Gigantic tropical fish tanks, sandwiches, drinks, snacks and Bloomberg terminals fill the upstairs lobby.

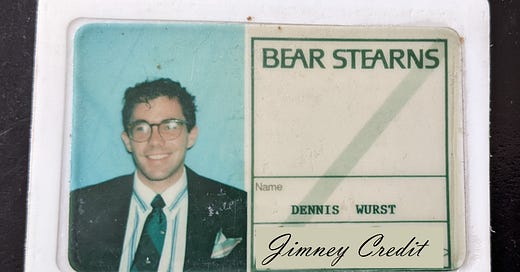

I simply show my Bear Stearns ID card at the front desk, and they let me inside.

Escape Plan

My departure deserves some planning. The New York Stock Exchange partner Jack says that I can always return as a wire clerk, but I really do not want a career mechanically executing stock trades for other people. I want to work where decisions are made.

I probably have to leave this department. I started here too young and will never grow up, in their eyes. Other departments are worth considering. I am not married to bankruptcy, distressed or high yield.

I can change product sector and re-invent myself in a setting that doesn’t know me since I was 17.

Eeyore thinks that I should move to the Bay Area for this internet thing or maybe try my hand at derivatives. I hope to impress that grumpy mortgage guy. With the gigantic glasses. Warren Spector! I won’t flinch when he barks. I’m totally used to it.

According to Hipster, I’m also “un-insultable.” That’s a compliment.

Hopefully, Warren appreciates that I started so young. I don’t flinch easily, if at all.

How can all this experience hurt my chances?

It can’t!

Share this post